Misconceptions

There is no incentive to run a node

Those familiar with Nakamoto Consensus (i.e. Bitcoin) mistakenly believe that a direct incentive is a requirement for all distributed ledger designs. Nakamoto Consensus is based on a synchronous blockchain with block producers and therefore relies on fees and/or a block reward to incentivize competition among block producers to secure the network.

Nano does not use a synchronous blockchain and therefore does not need to incentivize the network to compete to produce blocks and secure the network. Not having a direct incentive has major advantages, as it enables the following to coexist:

- feeless tx prioritization

- resist emergent centralization due to economies of scale

- consensus controlled by users

- a fixed supply

Additionally, many conflate a "node" and a "miner". In Nakamoto Consensus, it is only the latter that is incentivized. The incentives and reasons to run a Bitcoin node and a Nano node are the same. In both cases, the low cost of running a node allows people to run them to use the network without having to trust or rely on anybody else. The advantage in Nano's case is that it doesn't cost more to run a node that also secures and controls the network, as it does not require specialized hardware.

Nano's design is one based on cooperation, not competition, to maintain the security and value of the network.

Nano is too volatile to be a store of value or currency

All currencies (i.e. fiat money) are volatile. It is not noticeable when it is widely adopted and denominated.

The day-to-day price of milk, denominated in USD, is stable even though USD as a currency has day-to-day exchange rate volatility.

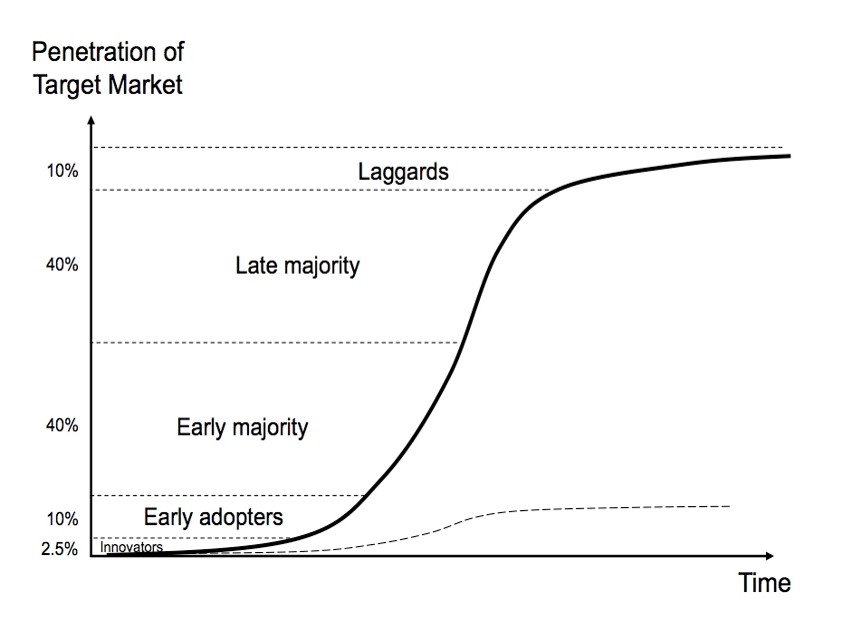

Nano currently has very little usage and adoption as a form of money. Like other technologies whose value is impacted by network effects, it is not worth much until it’s worth a lot. It can not go from zero usage and denomination to widely adopted and denominated without volatile price changes. This volatility is a symptom of its network effects growth, which at first will grow exponentially before stabilizing.

Currently, the price is entirely driven by speculation. In other words, Nano's value is not driven by its use but because people believe it will be used. As it grows to be widely adopted and denominated, the market price will no longer be determined purely from speculation by traders.

The price will begin to stabilize when it is predominately driven by utility and the network effects can no longer exponentially grow.

Understanding Network Effects of Digital Money

The internet era has been dominated by companies and products based on the concept of network effects, where the network becomes more valuable to users as more people use it. This is as true of companies like Amazon and Google as it is for open source projects like Wikipedia and cryptocurrencies. At its core, the theory behind network effects suggests that platforms and products with network effects get better as they get bigger — not just in value to users, but also in accruing more resources to improve their product or service.

The utility of digital money in aggregate is a function of how many merchants want to accept payment for goods and services in digital money. The more people who accept payment using digital money, the more merchants existing users can do business with.

In practice, network effects resemble an S-curve more than an exponential curve. The first 50% of merchants that accept digital cash for payment make it exponentially more useful than the second 50%.

Therefore, the value of digital money will exponentially increase at first then hit an inflection point before finally plateauing. In other words, digital money will start off behaving like a speculative investment before evolving into a stable store of value as its network effects and utilization mature.

Learn more about how it can be an investment now before it stabilizes as digital money.

Note: Nano can be used as a payment network by merchants without exposing them to the exchange volatility as they can trade in and out of it, as opposed to holding it.

Nano is a bad currency because it's deflationary or lacks inflation

Nearly all modern money systems are based on fiat money, leading to confusion and a lack of distinction between fiat money and money.

Nano is a bad form of fiat money but a superior form of money.

It's a bad form of fiat money because it cannot be used to respond to economic events since governments cannot control its supply. However, it's a better form of money as it has superior properties of money - mainly its store of value properties - because governments cannot control its supply.

Properties of Money

- Fungibility: its units must be capable of mutual substitution.

- Durability: able to withstand repeated use.

- Divisibility: divisible to small units.

- Portability: easily carried and transported.

- Cognizability: its value must be easily identified.

- Scarcity: its supply in circulation must be limited.

- Acceptability: widely accepted.

Functions of Money

- Medium of Exchange — to transfer value

- Store of Value — to hold value

- Measure of Value — to measure value

For a more detailed explanation read about its advantages and why it matters.

Nano is energy-efficient because nobody uses the network

The energy cost of producing a transaction is constant and the energy cost of running the network is essentially fixed. Thus, the network is most efficient when congested (energy usage per tx).

Nano is doomed because the developer fund is low

Nano is an open source project, a peer-to-peer network, and a set of ideas that do not rely on any one person, developer, or operator to exist. Some play much larger roles than others but Nano's existence doesn't depend on them, it depends on anyone who recognizes its usefulness.

It will not become any less useful if the developer fund runs out; those who recognize that will be quicker to support the project than abandon it. Bitcoin never had a developer fund and it's been just fine.

Nano will be replaced by a competitor or clone

For a competitor to replace Nano, it will need to materially improve upon Nano's fundamental properties. There is not much room for improvement, given Nano is instant, feeless, energy-efficient, scalable, and irreversible. Based on those qualities and how few advances there have been over the last 30 years, it may be more likely that Nano is not viable than there being an improvement discovered that is incompatible.

Since its release, Bitcoin has been forked and cloned countless times. None of these clones have been able to gain much traction because they lack legitimacy, a quality that can not be forged in decentralized networks.

The best technology does not always win

This is a common retort and, while it has some truth to it, it is something that mostly applies to start-ups, products, and companies.

Nano is none of those.

But what about the format wars? like VHS vs Betamax and Blu-ray vs HD DVD?

Betamax is, in theory, a superior recording format over VHS due to resolution (250 lines vs. 240 lines), slightly superior sound, and a more stable image; Betamax recorders were also of higher-quality construction. However, these differences were negligible to consumers and thus did not justify either the extra cost of a Betamax VCR (which was often significantly more expensive than a VHS equivalent) or Betamax's shorter recording time.

In short, Betamax lost because it wasn't perceivably better. Its advantages were not noticeable to consumers and it was more expensive, making it perceivably worse.

You can't just have better stats, you need to have the right stats that are better. Making improvements in areas that won't have an impact on consumers will go unnoticed.

Nano is cheaper, faster, and more energy-efficient. These are not just better stats, these are the right stats. And even if this is not perceivable by consumers, it will not go unnoticed by profit-driven market forces relentlessly trying to save time and money.